There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Break the Loop. Reclaim What's Yours.

✉️ From Jeevantika Finserv –Awareness Is Power. Action Is Wealth.

Tue Jun 17, 2025

A middle-aged man, Ganesh, stumbles across a share certificate in an old trunk while looking for some property documents. He checked with his son and finds that the company still exists. Its share price is thriving, and the value of the certificate is now in lakhs owing to few bonuses and split in shares in past 2 decades. Excited, he contacts the company to claim the shares. The company refers him to the Registrar and Transfer Agent (RTA). The RTA says the shares have been transferred to the Investor Education and Protection Fund (IEPF). The IEPF Authority, in turn, tells him to contact the company for documentation. The cycle repeats — shareholder trapped in a loop, his rightful money entangled in a bureaucratic web.

This is not an isolated case — it’s a systemic conundrum playing out across India.

India’s ₹2.5 Lakh Crore Mystery

As per various estimates, over ₹2.5 lakh crore worth of financial assets lie unclaimed across banks, mutual funds, insurance companies, and listed entities. A significant portion of this sits in the form of unclaimed shares. These aren’t just forgotten investments — they’re legacies, inheritances, and dormant wealth that remain locked due to procedural, structural, and emotional hurdles.

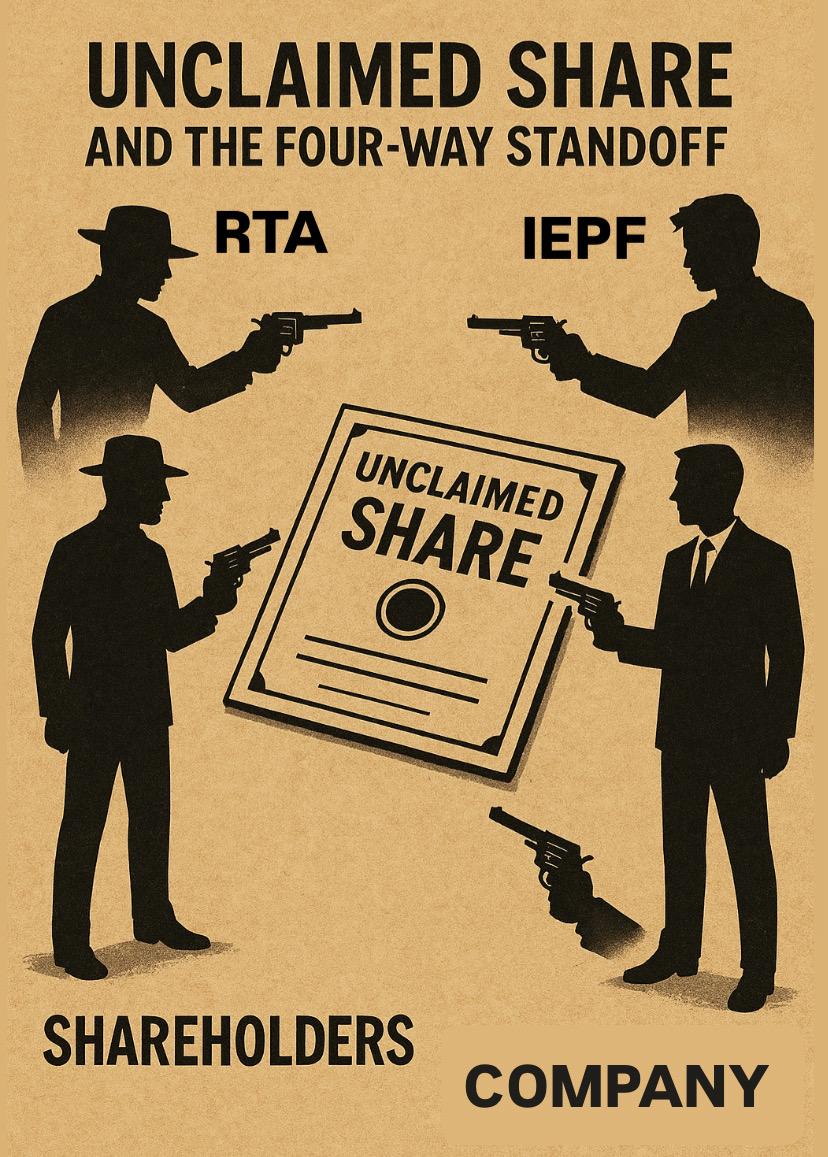

And at the centre of it all is a glaring trust deficit among the four key players — the Shareholder, the Company, the RTA, and the IEPF Authority.

The Mistrust That Fuels the Problem

What makes unclaimed share recovery so challenging is not just the paperwork — it’s the underlying mistrust between stakeholders.

Instead of collaboration, there’s hesitation. Instead of a joint problem-solving approach, there’s finger-pointing.

This lack of trust breeds delays, rejections, and abandonment — where legitimate claimants give up, and wealth meant for families languishes in bureaucratic limbo.

Four Players, Fragmented Accountability

Let’s examine each player’s role in this broken chain:

1. The Shareholder: The Forgotten Investor

Most shareholders who lose track of investments do so unknowingly — due to change in address, dematerialization not done, or the original holder passing away without clear succession. The heirs, often unaware and unequipped, get caught in a maze of legal and procedural complexities.

2. The Company: The Passive Participant

While companies are obligated to notify shareholders before transferring shares to IEPF, their support in the recovery process is often minimal. Some consider their role done once shares are moved to the fund, though they are legally required to verify claims later.

3. The RTA: The Paperwork Gatekeeper

RTAs demand rigorous documentation — KYC Proofs, legal heir/succession certificates, notarized indemnity/affidavits, newspaper ads — with little room for assistance or exceptions. Their cautiousness is understandable, but often misinterpreted by claimants as indifference.

4. The IEPF Authority: The Final Fort

Despite being the legal custodian, the IEPF Authority depends on others — the Company and RTA — to vet claims. The Authority itself rarely communicates directly with claimants, leading to further frustration. Further, they

The Need for Simplification, Trust, and Outreach

Unclaimed shares are a governance issue, not just a clerical one. They represent a breakdown of systems, communications, and relationships between stakeholders.

Here’s what India urgently needs:

And most importantly…

The Missing Link: Financial Intermediaries as Trust Bridges

To truly unlock these frozen assets, we must empower and involve financial intermediaries — Mutual Fund Distributors, Chartered Accountants, RIAs, and legal professionals — as facilitators in the process.

These professionals already have access to investor families, understand compliance processes, and hold public trust. With proper training, they can become the last-mile bridge between the system and the shareholder — simplifying paperwork, ensuring correct documentation, and handholding families through the claim journey.

At Jeevantika Innovations, we’ve built a framework to do exactly this — training hundreds of intermediaries to assist shareholders and heirs across India. But the scale of the issue demands a coordinated national effort.

Reclaiming More Than Just Shares

Unclaimed shares are more than forgotten paper assets — they are the frozen legacies of India's growing investor base. Reclaiming them restores more than wealth — it restores dignity, continuity, and trust in the financial system.

For that to happen, all four stakeholders must stop working in silos — and start working together.

Jeevantika Consultancy

Khagesh Chitlangiya is the founder at Jeevantika, which help families trace and recover their lost investments and trains and offers tech solutions to financial intermediaries.